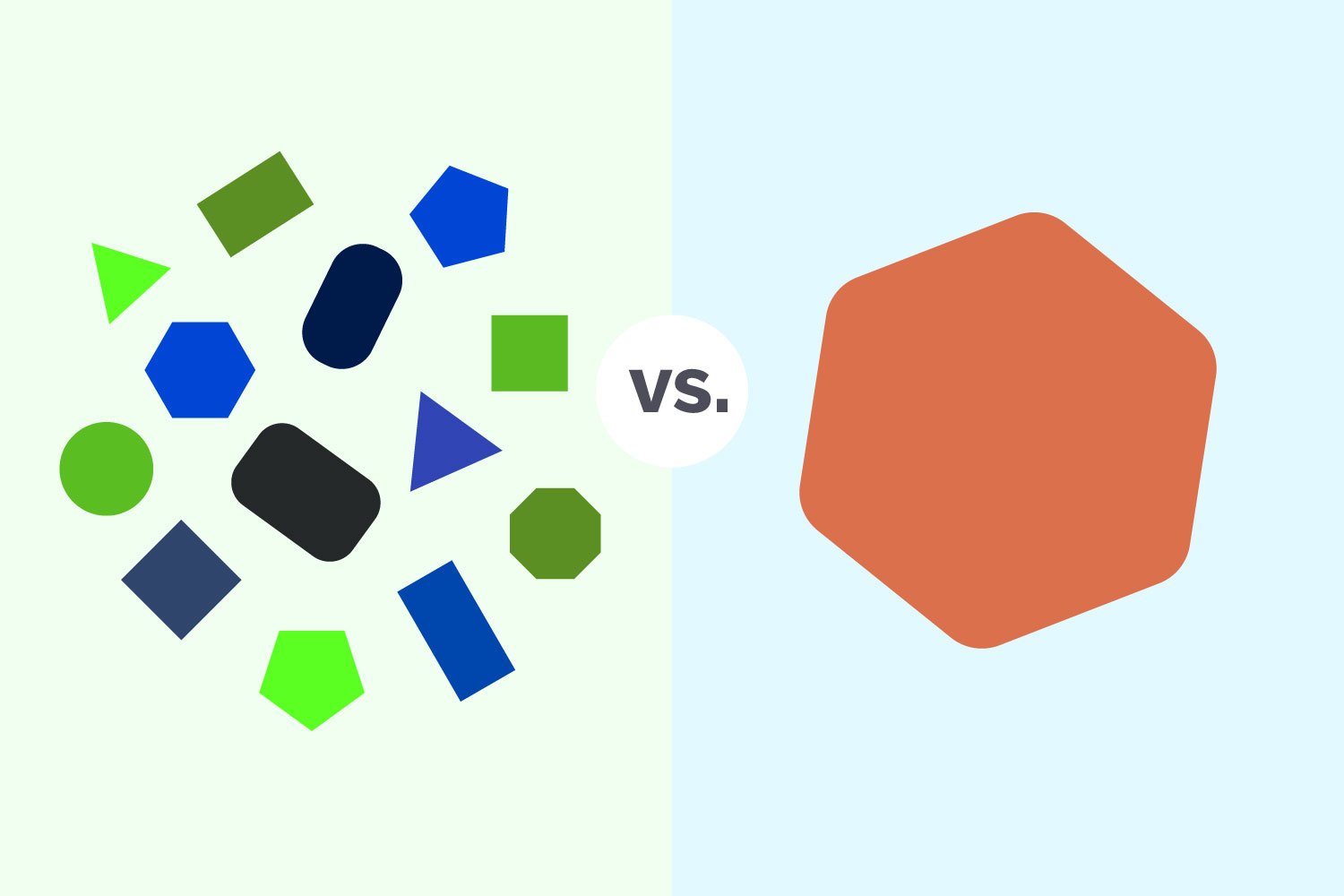

Diversification is a fundamental principle in investing. By spreading investments across a range of assets, investors can reduce the risk associated with any single holding. This strategy is often summarized by the adage, “Don’t put all your eggs in one basket.” The importance of diversification lies in its ability to mitigate losses from individual investments, thereby safeguarding your overall portfolio.

However, not all investors heed this advice. Some choose to concentrate their investments in a few stocks, often due to loyalty to a particular company, confidence in its future, or a lack of knowledge about diversification. These concentrated stock holdings can offer the allure of higher potential returns, but they come with significant risks.

Investors face a dilemma: Should they maintain concentrated positions in the hope of higher returns, or should they diversify to protect against potential losses? In this article, we’ll explore the risks associated with concentrated stock holdings, how to evaluate your portfolio’s concentration, and strategies for diversification.

Table of Contents

The Risks of Concentrated Stock Holdings

When an investor holds a concentrated position in a single stock or a small number of stocks, they expose themselves to several risks that can jeopardize their financial future. Understanding these risks is crucial for making informed investment decisions.

Market Volatility

Market volatility refers to the fluctuations in stock prices that occur in response to various factors such as economic data, geopolitical events, and market sentiment. When you have a concentrated position, your portfolio’s value is more vulnerable to these fluctuations.

For example, if you hold a large position in a technology company and the tech sector experiences a downturn, your portfolio could suffer significant losses. This is because your concentrated position amplifies the impact of sector-specific or company-specific events on your overall portfolio.

Diversification can help mitigate this risk by spreading investments across multiple sectors and asset classes, thereby reducing the impact of any single event on your portfolio.

Company-Specific Risks

Investing heavily in a single company exposes you to the risks associated with that company’s performance. These risks include poor management decisions, regulatory changes, competition, and technological disruptions.

For instance, if you were heavily invested in a company like Blockbuster in the early 2000s, you would have experienced substantial losses as the company failed to adapt to the rise of digital streaming services. In contrast, a diversified portfolio would have been less affected by Blockbuster’s decline because losses in that company could be offset by gains in other investments.

The lesson here is that no company is immune to failure, and relying heavily on a single stock can be a recipe for disaster.

Lack of Liquidity

Liquidity refers to the ease with which an asset can be bought or sold in the market without affecting its price. Concentrated stock holdings can present liquidity challenges, especially if the position represents a large portion of the company’s outstanding shares or if the company is thinly traded.

In such cases, selling a large concentrated position quickly may be difficult without driving down the stock’s price. This can result in lower proceeds from the sale than anticipated, particularly in a market downturn when liquidity tends to dry up.

Diversification, on the other hand, generally involves holding more liquid assets, which can be sold more easily if the need arises.

Emotional Biases

Investors often develop emotional attachments to stocks, particularly if they have a personal connection to the company (e.g., as an employee or a long-time customer). This emotional bias can cloud judgment and lead to poor investment decisions.

For instance, an investor might hold onto a losing stock for too long, hoping for a turnaround, even when the fundamentals suggest otherwise. Alternatively, they might refuse to sell a winning stock to avoid capital gains taxes, even if it means maintaining an over-concentrated position.

Emotional biases can be detrimental to long-term financial success. Diversification forces investors to spread their investments across multiple assets, reducing the influence of emotions on their portfolio decisions.

Evaluating Your Portfolio Concentration

To protect against the risks of concentrated stock holdings, it’s essential to evaluate the concentration of your portfolio regularly. This involves calculating your concentration, identifying risk factors, and comparing your portfolio to industry benchmarks.

Calculating Concentration

There are several methods to measure the concentration of your portfolio. One common approach is to calculate the percentage of your portfolio that is invested in a single stock or a small group of stocks.

For example, if 40% of your portfolio is invested in one company, your portfolio is highly concentrated. Another method is to use the Herfindahl-Hirschman Index (HHI), which is a measure of the concentration of holdings in a portfolio. The higher the HHI, the more concentrated the portfolio.

To calculate your portfolio’s HHI, square the percentage of each holding and sum these squares. For example, if your portfolio has three stocks with allocations of 50%, 30%, and 20%, the HHI would be:

- 50% squared = 2,500

- 30% squared = 900

- 20% squared = 400

- HHI = 2,500 + 900 + 400 = 3,800

An HHI below 1,500 indicates a well-diversified portfolio, while an HHI above 2,500 suggests high concentration.

Identifying Risk Factors

Once you’ve calculated your portfolio’s concentration, the next step is to identify the specific risks associated with your concentrated positions. Consider factors such as the company’s financial health, industry trends, and the overall economic environment.

Ask yourself the following questions:

- How dependent is the company on a single product or market?

- What is the company’s competitive position within its industry?

- How sensitive is the company’s stock to economic cycles?

By identifying these risk factors, you can better understand the potential vulnerabilities in your portfolio and take steps to address them.

Comparing to Benchmarks

Benchmarking your portfolio against industry standards is another way to assess its concentration. Common benchmarks include the S&P 500, which represents a broad cross-section of the U.S. stock market, and sector-specific indexes, such as the NASDAQ-100 for technology stocks.

If your portfolio is significantly more concentrated than these benchmarks, it may be time to consider diversifying your holdings. Keep in mind that even if your portfolio has outperformed the market in the past, concentration can lead to increased risk and potential underperformance in the future.

Strategies for Diversification

Diversification is the key to mitigating the risks associated with concentrated stock holdings. By spreading your investments across various asset classes, geographic regions, sectors, and funds, you can create a more balanced and resilient portfolio.

Asset Allocation

Asset allocation involves dividing your portfolio among different asset classes, such as stocks, bonds, and cash. Each asset class has different risk and return characteristics, which can help reduce the overall risk of your portfolio.

For example, if your portfolio is heavily weighted in stocks, adding bonds can provide stability during market downturns. Bonds typically have lower volatility than stocks and can act as a cushion when equity markets decline.

The ideal asset allocation depends on your risk tolerance, investment goals, and time horizon. A financial advisor can help you determine the right mix of assets for your specific situation.

Geographic Diversification

Investing in securities from various countries or regions is another way to achieve diversification. Geographic diversification reduces the impact of country-specific risks, such as political instability, economic downturns, or currency fluctuations.

For example, if your portfolio is heavily invested in U.S. stocks, consider adding international stocks or bonds. This can provide exposure to growing markets outside the U.S. and reduce the risk associated with a downturn in the U.S. economy.

Emerging markets, in particular, offer high growth potential, but they also come with higher risks. A diversified approach to geographic investment can help balance these risks.

Sector Diversification

Sector diversification involves spreading your investments across different industries or sectors, such as technology, healthcare, energy, and consumer goods. This strategy reduces the risk of overexposure to a single industry, which can be particularly important if that industry experiences a downturn.

For example, during the COVID-19 pandemic, the technology sector outperformed many other sectors, while industries like travel and hospitality suffered significant losses. A diversified portfolio that includes exposure to multiple sectors can help smooth out returns during such periods of economic stress.

Fund Diversification

Mutual funds and exchange-traded funds (ETFs) are popular tools for achieving diversification. These funds pool money from many investors to buy a diversified portfolio of stocks, bonds, or other assets. By investing in a single fund, you can gain exposure to a broad range of securities.

For example, an S&P 500 index fund provides exposure to 500 of the largest U.S. companies, while a global bond fund invests in bonds from around the world. Funds can also be sector-specific, allowing you to diversify within a particular industry.

ETFs, in particular, offer the added benefit of liquidity, as they trade on stock exchanges like individual stocks. This makes them an attractive option for investors looking to build a diversified portfolio with flexibility.

Case Studies

Real-world examples can illustrate the consequences of concentrated stock holdings and the benefits of diversification. These case studies provide valuable lessons for investors looking to manage risk and achieve long-term financial success.

Real-World Examples

One of the most famous examples of the dangers of concentrated stock holdings is the collapse of Enron. Many employees of the company had a significant portion of their retirement savings invested in Enron stock. When the company went bankrupt in 2001, these employees lost not only their jobs but also their life savings.

In contrast, investors who diversified their portfolios with a mix of stocks, bonds, and other assets were better able to weather the storm. While the Enron scandal caused significant losses for some, a diversified portfolio would have mitigated these losses and preserved more of the investor’s wealth.

Success Stories

On the other hand, diversification has proven successful for many investors. One such example is the Yale Endowment, which has consistently outperformed the market by employing a diversified investment strategy.

The endowment’s investment strategy includes a mix of domestic and international equities, real estate, private equity, and hedge funds. This diversification has allowed Yale to achieve strong returns while minimizing risk, even during periods of market volatility.

Another success story is that of Warren Buffett, who, while known for his concentrated bets on high-quality companies, also advocates for diversification. Buffett’s Berkshire Hathaway owns a diversified portfolio of businesses and investments, ranging from insurance to railroads to consumer goods. This diversification has contributed to the company’s long-term success.

Lessons Learned

The key lesson from these case studies is that diversification is essential for managing risk and achieving long-term financial success. Concentrated stock holdings can lead to significant losses if the underlying company or sector underperforms, while diversification provides a buffer against these risks.

Investors should regularly evaluate their portfolios for concentration and consider implementing diversification strategies to protect their wealth. By doing so, they can increase the likelihood of achieving their financial goals, regardless of market conditions.

In Conclusion: Avoid the High-Wire Act

Concentrated stock holdings can offer the potential for high returns, but they come with significant risks. Market volatility, company-specific risks, lack of liquidity, and emotional biases can all have a detrimental impact on a concentrated portfolio.

Diversification is the key to mitigating these risks. By spreading investments across various asset classes, geographic regions, sectors, and funds, investors can create a more balanced and resilient portfolio. Regularly evaluating your portfolio’s concentration, identifying risk factors, and comparing to benchmarks are essential steps in managing your investment risk.

So, to sum it up, while concentrated stock holdings can be tempting, diversification is a more prudent approach for long-term financial success. Investors should take actionable steps to evaluate and improve their portfolio diversification to protect their wealth and achieve their financial goals.