Imagine this: John, a 49-year-old professional, assumed he was on track financially because he’d earned a good salary throughout his career. However, it wasn’t until he began working with a financial advisor who calculated his net worth that he realized he was a little further behind than he had thought due to high spending and unpaid loans. Wishing he had known sooner, John had to adjust his spending and put a few projects on hold to get his financial future and retirement plan back on track.

Have you ever wondered how financially secure you are? Imagine knowing exactly where you stand financially at any given moment. This is where understanding your net worth comes into play. Net worth is a crucial indicator of financial health, serving as a foundation for effective financial planning. In this comprehensive guide, we’ll explore the importance of net worth, how to build your net worth statement, why it matters, and how to maintain and utilize it for long-term financial success.

Table of Contents

The Importance of Financial Planning

Financial planning is a journey, not a destination. Many people set out on this journey without a clear map, leading to missed opportunities and financial stress. One powerful tool in your financial planning arsenal is your net worth statement. By understanding and regularly updating your net worth, you gain insights into your financial health and progress towards your goals.

What is Net Worth?

Net worth is a measure of your financial position at a specific point in time. It is calculated by subtracting your total liabilities (debts) from your total assets (what you own). A positive net worth indicates that you own more than you owe, while a negative net worth means you owe more than you own. Understanding your net worth is essential for making informed financial decisions and planning for the future.

The Role of Net Worth in Financial Wellness

Your net worth serves as a financial report card. It provides a clear picture of where you stand financially and helps you track your progress over time. By regularly updating your net worth statement, you can identify trends, set realistic financial goals, and make adjustments to your financial plan as needed.

Part 1: Building Your Net Worth Statement

What is a Net Worth Statement?

A net worth statement is a snapshot of your financial health at a specific point in time. It summarizes your assets (what you own) and liabilities (what you owe) to provide a clear picture of your financial position. Creating a net worth statement is the first step towards understanding and improving your financial health.

Components of a Net Worth Statement

Assets

Assets are items of value that you own. They can be categorized into several types:

- Cash and Cash Equivalents

- Checking Accounts: These are your everyday transaction accounts.

- Savings Accounts: These include savings for short-term and long-term goals.

- Emergency Fund: A dedicated fund for unexpected expenses.

- Investments

- Real Estate

- Primary Residence: The market value of your home.

- Rental Properties: The market value of any rental properties you own.

- Personal Property

- Vehicles: The market value of your car or other vehicles.

- Jewelry and Collectibles: Estimated value of valuable personal items.

- Other Assets

- Business Equity: Ownership in businesses.

- Life Insurance Cash Value: If applicable, the cash value of life insurance policies.

Liabilities

Liabilities are debts or obligations you owe. They can include:

- Mortgages

- Home Loans: The balance owed on your primary residence.

- Rental Property Loans: The balance owed on rental properties.

- Student Loans

- Education Debt: Total outstanding student loan debt.

- Auto Loans

- Car Loans: Remaining balance on any car loans.

- Credit Card Debt

- Credit Card Balances: Total of all credit card balances.

- Other Debts

- Personal Loans: Any personal loans you owe.

- Medical Bills: Outstanding medical expenses.

- Other Liabilities: Any other outstanding debts.

Creating Your Net Worth Statement

Creating a net worth statement involves listing all your assets and liabilities and calculating the difference between the two. Here is a step-by-step guide to creating your net worth statement:

- List Your Assets

- Create a list of all your assets, including their current market value.

- Use recent statements and market values to ensure accuracy.

- List Your Liabilities

- Create a list of all your liabilities, including the current balances owed.

- Use recent statements to ensure accuracy.

- Calculate Your Net Worth

- Subtract your total liabilities from your total assets to calculate your net worth.

- Review and Update

- Review your net worth statement regularly and update it as needed to reflect changes in your financial situation.

Part 2: Why Net Worth Matters

Financial Benchmarking

Tracking your net worth over time allows you to benchmark your financial progress. It helps you measure how well you are doing in achieving your financial goals and provides a clear picture of your financial health. By comparing your net worth to national averages or to your own past performance, you can gauge your progress and identify areas for improvement.

National Averages

Comparing your net worth to national averages can be a motivating factor. It helps you understand where you stand in relation to others and set realistic financial goals. National averages can vary by age, income level, and other factors, so it’s important to consider these variables when making comparisons.

Identifying Strengths and Weaknesses

A net worth statement provides valuable insights into your financial strengths and weaknesses. By analyzing your assets and liabilities, you can identify areas where you are excelling and areas that need improvement.

Strengths

- High Savings: A strong savings account balance and healthy investment portfolio indicate financial strength.

- Low Debt: Minimal debt levels, particularly high-interest debt like credit cards, are a sign of financial health.

Weaknesses

- High Debt: High levels of debt, especially if it exceeds your assets, can be a red flag.

- Low Savings: Insufficient savings and lack of emergency funds are areas that need attention.

Goal Setting and Planning

Knowing your net worth is crucial for setting and achieving financial goals. It provides a foundation for your financial plan and helps you prioritize your goals based on your current financial situation.

Financial Goals

- Retirement Savings: Determine how much you need to save for a comfortable retirement.

- Major Purchases: Plan for major expenses like buying a house or a car.

- Debt Reduction: Set goals for paying off high-interest debt and improving your financial health.

Planning

- Budgeting: Use your net worth statement to create a budget that aligns with your financial goals.

- Investment Strategy: Develop an investment strategy based on your net worth and financial goals.

Motivation and Accountability

Tracking your net worth over time fosters a sense of accomplishment and helps you stay accountable to your financial goals. Regular updates to your net worth statement provide tangible evidence of your progress and motivate you to continue working towards your goals.

Part 3: Maintaining and Utilizing Your Net Worth Statement

Frequency of Updates

It’s important to update your net worth statement regularly to ensure it accurately reflects your financial situation. Quarterly or biannual updates are recommended to track changes and analyze trends over time.

Tools and Resources

There are many tools and resources available to help you create and maintain your net worth statement. These include free online templates, budgeting apps, and financial planning software.

Online Templates

- Free Templates: Many websites offer free net worth statement templates that you can download and use.

- Customizable Options: Look for templates that allow you to customize categories to fit your specific needs.

Budgeting Apps

- Personal Finance Apps: Apps like Mint, YNAB (You Need A Budget), and Personal Capital offer tools for tracking your net worth.

- Features: Look for apps that offer features like automatic updates, detailed reports, and goal tracking.

Financial Planning

Your net worth statement is a valuable tool for financial planning. It serves as a starting point for consultations with a financial planner and helps create a personalized roadmap to achieve your financial goals.

Financial Planner

- Consultations: A financial planner can help you analyze your net worth statement and develop a plan to achieve your goals.

- Personalized Advice: They can provide personalized advice on budgeting, saving, investing, and debt reduction.

In Conclusion

A net worth statement is an essential tool for anyone serious about financial wellness. It provides a clear picture of your current financial standing and helps you set and achieve future financial goals. Start today by creating your own net worth statement and take the first step towards financial freedom.

Call to Action

I encourage you to take action now and contact a fiduciary financial advisor that will calculate one for you, or create your own net worth statement. Use the tools and resources available to you and start tracking your financial progress today. By understanding your net worth, you can make informed financial decisions, set realistic goals, and achieve financial freedom.

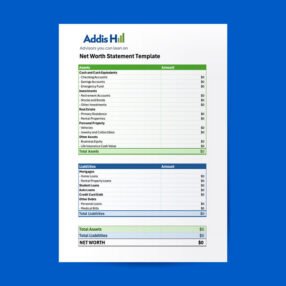

Bonus: Sample Net Worth Statement Template

To help you get started, here is a sample net worth statement template. Use this template to create your own net worth statement and begin your journey to financial wellness.

By using this template and following the steps outlined in this guide, you can take control of your financial future and work towards achieving financial freedom. Remember, the journey to financial wellness begins with understanding where you stand today. Start tracking your net worth and make informed decisions to secure a prosperous future.