When it comes to retirement savings, one of the most common dilemmas people face is whether to contribute to a Traditional 401(k) or a Roth 401(k). In our practice, we frequently analyze 401(k) statements, and it’s crucial to understand the intricacies of how much you are contributing, the employer’s match, and the allocation of funds within the employer’s offered plans. Often, we see contributions being made pre-tax, adhering to the conventional wisdom of lowering taxable income now and expecting to withdraw funds in a lower tax bracket during retirement. But is this approach genuinely beneficial? Let’s dive into a detailed analysis to help you make an informed decision.

Table of Contents

Understanding the Basics

Traditional 401(k)

A Traditional 401(k) allows you to contribute pre-tax dollars, reducing your taxable income in the year of contribution. The idea is to defer taxes until retirement when you may be in a lower tax bracket. Here’s how it typically works:

- Contributions: Made with pre-tax dollars.

- Tax Benefit: Immediate reduction in taxable income.

- Withdrawals: Taxed as ordinary income upon retirement.

Roth 401(k)

In contrast, a Roth 401(k) is funded with post-tax dollars. Although you don’t receive an immediate tax break, the money grows tax-free, and withdrawals during retirement are also tax-free, provided certain conditions are met.

- Contributions: Made with post-tax dollars.

- Tax Benefit: Tax-free growth and withdrawals.

- Withdrawals: Not taxed, provided the account has been open for at least five years and the account holder is over 59½.

Assumptions for Our Analysis

To conduct a fair comparison, we have made several assumptions:

- Participant’s Age: 45

- Retirement Age: 67

- Life Expectancy: 92

- Investment Allocation: 80% stocks, 20% bonds, with a 6.24% average annual return based on current capital market assumptions (historical return is 8.2%).

- Annual Contribution: $22,500

- Tax Rate: Flat 25% while working, retired, and for heirs.

- No Other Cash Flows: Excluding Social Security, withdrawals, or any additional income.

As of 2025, the annual 401(k) contribution limit has increased to $23,500, slightly higher than the $22,500 figure used in this analysis.

Detailed Analysis

Pre-Tax 401(k) Contributions

Contributions and Tax Benefits

If the participant invests $22,500 annually into a pre-tax 401(k) over 21 years, the total contributions amount to $472,500. The immediate tax benefit from these contributions is $118,125 (25% of $472,500), reducing the actual cost to $354,375.

Growth of Investments

With an average annual return of 6.24%, these contributions grow to $1,134,000 by the time the participant reaches 67. By age 92, assuming the funds remain untouched, the balance grows to $4,277,000.

Required Minimum Distributions (RMDs)

Starting at age 75, the participant must begin taking RMDs. The accumulated sum of these distributions, after taxes and reinvestment, results in a non-IRA account total of $2,509,000. The remaining balance in the IRA by age 92 is $1,713,000.

After-Tax Value

Combining the tax deduction received and the total value, the real money accumulated is $4,396,000. However, upon death, the heirs must pay taxes on the remaining IRA balance, which amounts to $428,000 at a 25% tax rate. The net after-tax value for the heirs is $3,967,000.

Post-Tax (Roth) 401(k) Contributions

Contributions and Additional Taxes

Contributing $22,500 annually to a Roth 401(k) means paying taxes upfront. Over 21 years, the total extra tax paid on these contributions is $234,000.

Growth of Investments

Similarly, the Traditional 401(k), the Roth 401(k) grows to $1,134,000 by age 67 and to $5,152,000 by age 92.

Tax-Free Withdrawals

Since contributions were made with post-tax dollars, no taxes are owed on withdrawals. Thus, the total money available in the Roth 401(k) account is $4,917,000.

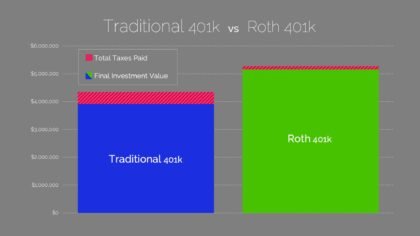

Comparing the Two Options

Lifetime Value Comparison

- Traditional 401(k): Net after-tax value is $3,967,000.

- Roth 401(k): Total value is $4,917,000.

The Roth 401(k) shows a significant advantage, with approximately $1,000,000 more in after-tax value than the Traditional 401(k).

Factors to Consider

Tax Rate Assumptions

Our analysis assumes a flat 25% tax rate. However, tax rates can vary based on changes in legislation, individual circumstances, and other factors. Therefore, it’s essential to consider the likelihood of tax rate changes in the future.

In July 2025, the One Big Beautiful Bill (H.R. 1) permanently extended the current federal tax brackets and standard deduction, eliminating the anticipated tax increases previously scheduled for 2026.

Additionally, starting in 2025, taxpayers age 65 and older benefit from a new Senior Deduction of up to $6,000 ($12,000 married filing jointly), potentially lowering taxable income during retirement.

Investment Returns

We used a conservative average annual return of 6.24%, which is 2% lower than historical returns. Small changes in return rates can significantly impact the final amounts due to the power of compounding.

Personal Financial Situations

Individual circumstances, such as expected income during retirement, other sources of retirement income (e.g., Social Security), and anticipated expenses, can influence the choice between a Traditional and Roth 401(k).

Making an Informed Decision

Immediate Tax Benefits vs. Future Tax Savings

The decision largely depends on whether you value immediate tax savings (Traditional 401(k)) or future tax-free withdrawals (Roth 401(k)). If you expect to be in a higher tax bracket in retirement, a Roth 401(k) might be more advantageous.

Flexibility and Control

Roth 401(k)s offer more flexibility since you won’t have to pay taxes on withdrawals, allowing for better financial planning in retirement. Additionally, Roth accounts do not have RMDs, providing more control over your retirement funds.

Estate Planning

For those considering leaving an inheritance, Roth 401(k)s can be more beneficial as heirs do not have to pay taxes on the inherited amount, potentially leaving a larger estate.

In Conclusion

Choosing between a Traditional 401(k) and a Roth 401(k) is a critical decision that can significantly impact your financial future. While the immediate tax benefits of a Traditional 401(k) are appealing, the long-term tax-free growth and withdrawals of a Roth 401(k) often provide a substantial financial advantage. Our analysis, based on several assumptions, demonstrates a notable benefit in favor of the Roth 401(k). However, it is crucial to consider your personal financial situation, future tax rate expectations, and retirement goals. Consulting with a financial advisor can provide personalized guidance tailored to your unique circumstances.

By understanding the differences and potential outcomes of each option, you can make a more informed decision that aligns with your long-term financial objectives.