In today’s competitive job market, equity compensation has become an attractive incentive offered by many employers. Among the most common forms of equity compensation are stock options and restricted stock. But what exactly are these financial instruments, and how can they impact your personal finances?

Understanding stock options and restricted stock is crucial for employees who want to make the most out of their compensation packages. These tools offer the potential for significant financial rewards, but they also come with risks and complexities that require careful consideration.

Whether you are new to equity compensation or looking to deepen your knowledge, this article will provide you with a comprehensive overview of stock options and restricted stock. We will explore their benefits, risks, taxation, and how they can be incorporated into your overall financial plan.

Table of Contents

Understanding Stock Options

Basics of Stock Options

Stock options give employees the right, but not the obligation, to purchase shares of the company’s stock at a predetermined price, known as the strike price or exercise price, within a specified period. These options are typically granted as part of a compensation package, allowing employees to benefit from the company’s future growth.

There are two primary types of stock options: call options and put options. In the context of employee compensation, the focus is on call options, which give the holder the right to buy shares at the strike price.

Types of Stock Options

- Incentive Stock Options (ISOs):

ISOs are typically offered to key employees and executives. They come with favorable tax treatment, provided certain conditions are met. When an employee exercises ISOs and holds the shares for a specified period, any gain is taxed as a long-term capital gain rather than ordinary income. - Non-Qualified Stock Options (NQSOs):

NQSOs are more common and can be offered to a broader range of employees. Unlike ISOs, NQSOs do not qualify for special tax treatment. When exercised, the difference between the strike price and the market value of the shares is taxed as ordinary income.

Option Pricing

Understanding the pricing of stock options is critical for making informed decisions. The key components include:

- Strike Price: The price at which you can purchase the stock, as specified in the option grant.

- Market Price: The current price of the stock in the market.

- Expiration Date: The date by which the option must be exercised, or it will expire.

- Volatility: A measure of the stock’s price fluctuations, which affects the option’s value.

- Time Value: The remaining time until the option’s expiration, influencing its price.

Taxation of Stock Options

The tax treatment of stock options varies depending on whether they are ISOs or NQSOs. With ISOs, if you meet the holding period requirements, you may qualify for favorable capital gains tax rates. However, if the shares are sold before the required holding period, the gain is subject to ordinary income tax rates.

For NQSOs, the spread between the strike price and the market price at the time of exercise is considered ordinary income and is subject to payroll taxes. Subsequent gains or losses from holding the shares are treated as capital gains or losses.

Strategies for Exercising Stock Options

Exercising stock options is a significant financial decision that requires careful planning. Here are some strategies to consider:

- Early Exercise: Exercising options early can allow you to lock in a lower purchase price and potentially benefit from long-term capital gains tax treatment.

- Cashless Exercise: This method allows you to exercise your options without needing to pay the strike price out of pocket by selling some of the shares immediately to cover the cost.

- Hold and Sell Later: You may choose to exercise your options and hold onto the shares, hoping that the stock price will continue to rise, increasing your potential profit.

- Sell to Cover: This involves selling just enough shares to cover the exercise price and taxes, allowing you to retain some shares for future appreciation.

Restricted Stock (RSUs)

What Are RSUs?

Restricted Stock Units (RSUs) are a type of equity compensation where an employee is granted shares of the company’s stock, subject to certain restrictions and vesting conditions. Unlike stock options, RSUs represent actual shares of stock, although they do not provide immediate ownership.

Vesting Schedules

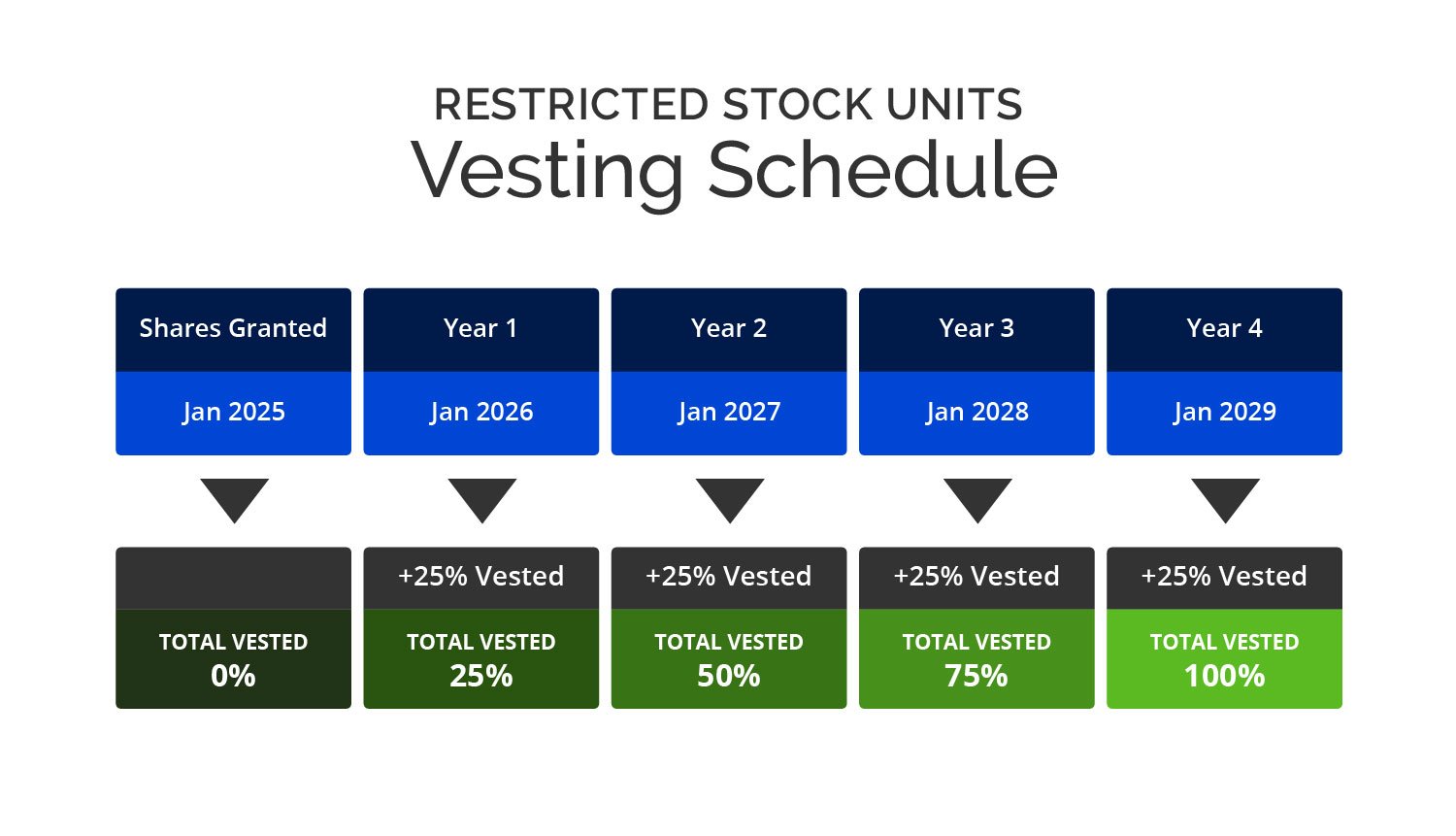

RSUs are typically subject to vesting schedules, meaning the shares are not fully owned by the employee until certain conditions are met. The two most common types of vesting schedules are:

- Time-Based Vesting: RSUs vest over a predetermined period, often in increments (e.g., 25% of the shares vest each year over four years).

- Performance-Based Vesting: Vesting occurs only if specific performance targets or milestones are achieved, such as the company reaching certain financial goals.

Taxation of RSUs

RSUs are taxed differently than stock options. When RSUs vest, the value of the shares is considered ordinary income and is subject to payroll taxes. The amount taxed is based on the market value of the shares on the vesting date. Any subsequent gain or loss from selling the shares is treated as a capital gain or loss.

One strategy to manage the tax burden is to sell some of the shares immediately upon vesting to cover the tax liability, a process known as “sell to cover.”

Risks and Considerations of RSUs

While RSUs provide the benefit of guaranteed shares upon vesting, they also come with risks. The value of the shares can fluctuate based on the company’s stock performance, and there may be a lack of liquidity if you are restricted from selling the shares immediately.

Employees should also consider the concentration risk of holding too much of their wealth in a single company’s stock, as well as the potential impact on their overall financial goals.

Stock Options vs. Restricted Stock: A Comparison

Key Differences Between Stock Options and RSUs

Stock options and RSUs are both forms of equity compensation, but they have significant differences:

- Ownership: Stock options give the right to purchase shares, while RSUs represent actual shares that are granted upon vesting.

- Taxation: Stock options can be taxed as ordinary income or capital gains, depending on the type and timing of exercise. RSUs are taxed as ordinary income upon vesting.

- Risk: Stock options carry the risk that the stock price may never exceed the strike price, making them worthless. RSUs, on the other hand, have value upon vesting regardless of stock performance.

Which One is Better for You? Factors to Consider

The choice between stock options and RSUs depends on several factors, including your financial goals, risk tolerance, and the specific terms of your compensation package. Here are some considerations:

- Risk Tolerance: If you are risk-averse, RSUs may be more appealing because they provide guaranteed shares upon vesting.

- Growth Potential: If you believe strongly in the company’s growth potential, stock options may offer higher upside if the stock price appreciates significantly.

- Liquidity Needs: Consider whether you need immediate access to cash. RSUs vest and are taxable immediately, while stock options can be exercised and sold at your discretion.

Diversifying Your Equity Compensation

Regardless of whether you receive stock options, RSUs, or both, it’s essential to diversify your portfolio. Holding too much of your wealth in a single company’s stock can expose you to significant risk if the company’s stock price declines.

Consider selling some of your vested RSUs or exercised stock options to reinvest in a diversified portfolio that aligns with your financial goals.

Financial Planning with Stock Options and Restricted Stock

Incorporating Equity Compensation into Financial Plans

Equity compensation should be integrated into your overall financial plan. This involves considering your risk tolerance, liquidity needs, and long-term financial goals.

Work with a financial advisor to create a plan that balances the potential rewards of stock options and RSUs with the need for diversification and risk management.

Risk Management Strategies

Equity compensation can be a double-edged sword, offering the potential for significant gains but also carrying risks. Here are some strategies to manage those risks:

- Limit Concentration: Avoid holding too much of your net worth in company stock. Aim to diversify your investments across different asset classes.

- Set a Selling Plan: Establish a plan for selling your shares over time, based on predefined price targets or life events, to reduce emotional decision-making.

- Monitor Company Performance: Stay informed about your company’s financial health and industry trends. If the company faces challenges, it may be wise to reduce your exposure.

Tax Planning Considerations

Taxes can significantly impact the value of your equity compensation. Here are some tax planning strategies:

- Optimize Exercise Timing: For stock options, consider the timing of exercise to manage the tax impact, especially if you are in a higher tax bracket.

- Use Tax-Advantaged Accounts: If possible, consider using tax-advantaged accounts like IRAs or 401(k)s to manage the tax implications of equity compensation.

- Consult a Tax Professional: Equity compensation is complex, and the tax implications can be significant. Working with a tax professional can help you navigate these challenges.

Estate Planning for Equity Compensation

Equity compensation can also play a role in estate planning. Consider how stock options and RSUs will be treated in the event of your death, and work with an estate planning attorney to ensure your wishes are carried out.

For example, ISOs may lose their favorable tax treatment if not exercised within a specific time frame after death. RSUs may be subject to estate taxes, and the transfer of ownership can be complex.

Working with a Financial Advisor

Given the complexities of stock options and RSUs, working with a financial advisor who understands equity compensation can be invaluable. An advisor can help you develop a strategy that aligns with your financial goals, manages risks, and minimizes taxes.

In Conclusion: Harness the Power of Equity Compensation

Stock options and restricted stock are powerful tools in the world of equity compensation. They offer employees the opportunity to share in their company’s success and can play a significant role in building wealth. However, they also come with risks and complexities that require careful planning and understanding.

By learning the ins and outs of stock options and RSUs, you can make informed decisions that maximize the benefits of your compensation package. Whether you are planning to exercise stock options, manage vested RSUs, or incorporate equity compensation into your overall financial plan, it’s crucial to approach these decisions with knowledge and foresight.

Don’t hesitate to seek professional advice to ensure you are making the most of your equity compensation. A financial advisor can help you navigate the complexities, optimize your strategy, and achieve your financial goals.