Are your Social Security benefits taxed? In this video, Chip Addis shares four must-know tips to help you understand when and how your benefits may be taxed—and what strategies can help reduce your tax bill. From the combined income formula to Roth IRA withdrawals and qualified charitable distributions, these insights can help you keep more of what you’ve earned.

VIDEO TRANSCRIPT:

Table of Contents

Social Security Isn’t Always Tax-Free

A lot of retirees are surprised to learn that Social Security benefits can be taxable. Depending on your income, up to 85% of your benefits could be subject to federal income tax.

Here are four tips to help you understand how it works—and how to manage your retirement income more efficiently.

Tip 1: Understand the Combined Income Formula

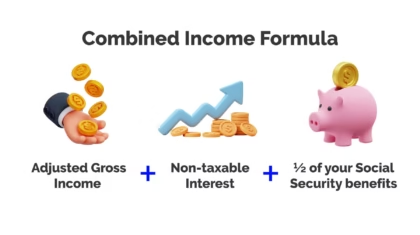

The IRS uses a specific formula to determine how much of your Social Security benefit is taxable. It’s called your combined income:

Adjusted Gross Income + Non-taxable interest + ½ of your Social Security benefits = Combined Income

Here’s how the tax applies:

-

Married Filing Jointly:

-

Over $44,000 → up to 85% taxable

-

$32,000–$44,000 → up to 50% taxable

-

Below $32,000 → 0% taxable

-

-

Single Filers:

-

Over $34,000 → up to 85% taxable

-

$25,000–$34,000 → up to 50% taxable

-

Below $25,000 → 0% taxable

-

Generally knowing where you fall helps guide decisions on how much income to generate—and from where.

Tip 2: Know the 3 Social Security Tax Scenarios

Here’s a quick rule-of-thumb breakdown:

-

Low-income retirees: Often pay no tax on benefits (especially after the standard deduction)

-

Moderate-income retirees: Typically taxed on 50% of their benefits

-

High-income retirees: Can expect up to 85% of benefits to be taxable

Basically, it’s a tiered system—not all or nothing—therefore planning around income thresholds can make a meaningful difference.

Tip 3: Use Roth IRA Withdrawals to Stay Below Thresholds

One smart strategy is to withdraw from a Roth IRA, because those withdrawals do not count toward your combined income.

If you’re close to the line on one of those income thresholds, a Roth can help you stay under—and reduce or eliminate the tax on your Social Security benefits.

Tip 4: Use Qualified Charitable Distributions (QCDs)

Another key point is if you’re over age 70½, you can make charitable donations directly from your IRA—these are called Qualified Charitable Distributions (QCDs).

Qualified Charitable Distributions (QCDs):

-

Satisfy your Required Minimum Distribution (RMD)

-

Don’t count as taxable income

-

Help reduce your combined income, markedly lowering or eliminating Social Security tax exposure

If charitable giving is part of your plan anyway, this can be a win-win.

Final Thoughts

Social Security taxation is complex—however it’s manageable with smart planning. By understanding how the formula works and making strategic use of Roth accounts or QCDs, you can reduce your tax burden and keep more of your retirement income.