When it comes to investing in bonds, understanding the concept of Yield to Maturity (YTM) is crucial for making informed decisions. Without it you’re kinda flying blind. Essentially, YTM is a comprehensive measure that helps investors assess the total return expected on a bond if held until it matures. In this article, we’ll break down the intricacies of YTM, explore its significance, and demonstrate how it can influence your investment strategy. Whether you’re new to bond investing or simply looking to deepen your knowledge, this guide will provide you with the insights needed to unlock a true understanding and potential of your bond investments.

Table of Contents

What is Yield to Maturity (YTM)?

Yield to Maturity (YTM) is the total return an investor can expect to earn if a bond is held until it matures. It accounts for all future coupon payments (interest) and the difference between the bond’s current market price and its face value (principal repayment at maturity). YTM is expressed as an annual percentage rate and provides a standardized way to compare the returns of different bonds.

How YTM is Calculated

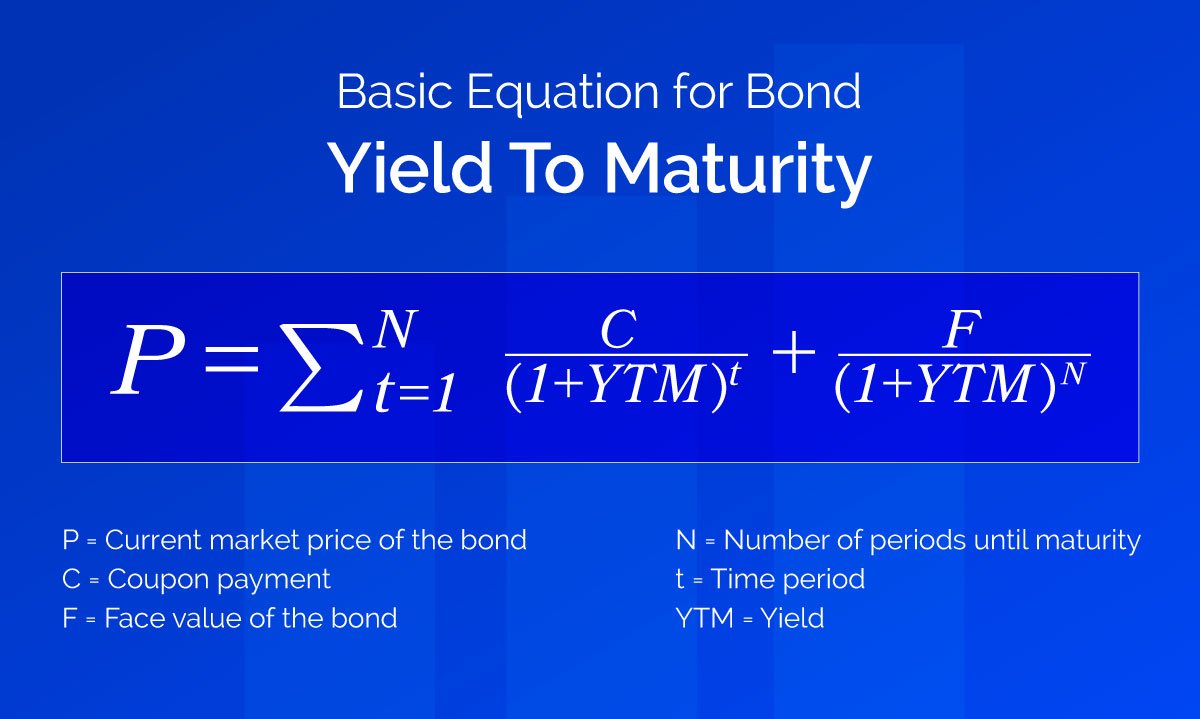

The formula for YTM is complex and financial professionals, like myself, typically use a financial calculator or software to measure a bond’s yield to maturity. But for the more academically inclined, I have include a more technical explanation. The calculation of YTM involves solving for the discount rate that equates the present value of all future cash flows (coupon payments and principal repayment) to the bond’s current market price. The basic concept can be understood through this simplified (if you can call it that) equation:

Essentially, YTM is the interest rate that makes the present value of the bond’s cash flows equal to its current price.

Factors Influencing YTM

Several factors can influence the YTM of a bond:

- Coupon Rate: The bond’s coupon rate, is the annual interest payment as a percentage of its face value. It affects the bond’s cash flows and, consequently, its YTM.

- Current Market Price: The bond’s price in the secondary market can fluctuate. It’s based on supply and demand, interest rates, and the issuer’s creditworthiness. Changes in the market price impact the YTM.

- Time to Maturity: The remaining time until the bond matures affects the number of coupon payments and the present value calculation, influencing the YTM.

- Credit Risk: The issuer’s credit rating can affect investor perception of risk. Higher credit risk typically leads to higher YTM to compensate investors for the increased risk.

Significance of YTM for Investors

Understanding YTM is vital for bond investors for several reasons:

- Total Return Measurement: YTM provides a comprehensive measure of the bond’s total return. This includes interest income and capital gains or losses, offering a complete picture of potential returns.

- Comparison Tool: YTM allows investors to compare bonds with different maturities, coupon rates, and prices on a standardized basis. Subsequently, YTM is a great tool to facilitate better investment decisions.

- Interest Rate Sensitivity: YTM helps investors understand how changes in interest rates affect bond prices. Bonds with higher YTM are more sensitive to interest rate fluctuations.

Types of Bonds and YTM

Different types of bonds can have varying implications for YTM:

- Zero-Coupon Bonds: These bonds do not pay periodic interest. Instead, they are issued at a discount to their face value and mature at par. The YTM for zero-coupon bonds is derived entirely from the difference between the purchase price and the maturity value.

- Callable Bonds: These bonds can be redeemed by the issuer before maturity at a specified call price. Investors should consider Yield to Call (YTC) in addition to YTM when evaluating callable bonds, as the issuer may call the bond if interest rates decline.

- Convertible Bonds: These bonds can be converted into a specified number of the issuer’s shares. The potential for conversion adds complexity to YTM calculations, as the bond’s value can be influenced by the stock’s performance.

YTM and Investment Strategies

YTM plays a critical role in shaping bond investment strategies:

- Laddering: Creating a bond ladder involves purchasing bonds with staggered maturities. This strategy helps manage interest rate risk and provides liquidity at regular intervals. Understanding the YTM of each bond in the ladder is essential for assessing overall returns.

- Barbell Strategy: This strategy involves investing in short-term and long-term bonds while avoiding intermediate maturities. The goal is to balance the higher yields of long-term bonds with the liquidity and lower risk of short-term bonds. YTM analysis helps determine the optimal mix.

- Immunization: This strategy aims to match the duration of a bond portfolio with the investor’s investment horizon to mitigate interest rate risk. YTM is a key factor in calculating duration and ensuring the portfolio remains immune to interest rate changes.

Risks and Considerations

While YTM is a powerful tool, investors should be aware of its limitations and associated risks:

- Reinvestment Risk: YTM assumes that all coupon payments are reinvested at the same rate, which may not be realistic if interest rates change.

- Market Risk: YTM does not account for changes in bond prices due to market conditions or investor sentiment.

- Credit Risk: Changes in the issuer’s credit rating can affect the bond’s market price and, consequently, its YTM.

In Conclusion

Yield to Maturity (YTM) is a fundamental concept for bond investors. It provides a comprehensive measure of the total return expected from a bond if held to maturity. By understanding the factors influencing YTM, its significance, and how to incorporate it into investment strategies, you can make significantly more informed decisions and maximize your bond investments. Whether you’re building a bond portfolio or evaluating individual bonds, consider YTM as a key metric to unlock the true potential of your investments and navigate the bond market with confidence.