Most have filed their 2022 tax return by now. So, let’s try to take a complicated topic and try to make it a little simpler. Before it starts gathering dust on a shelf pull it out and look at things through a different lens. We are amazed at how few people really understand how a tax return works and how you can make smarter decisions to really pay less to Uncle Sam.

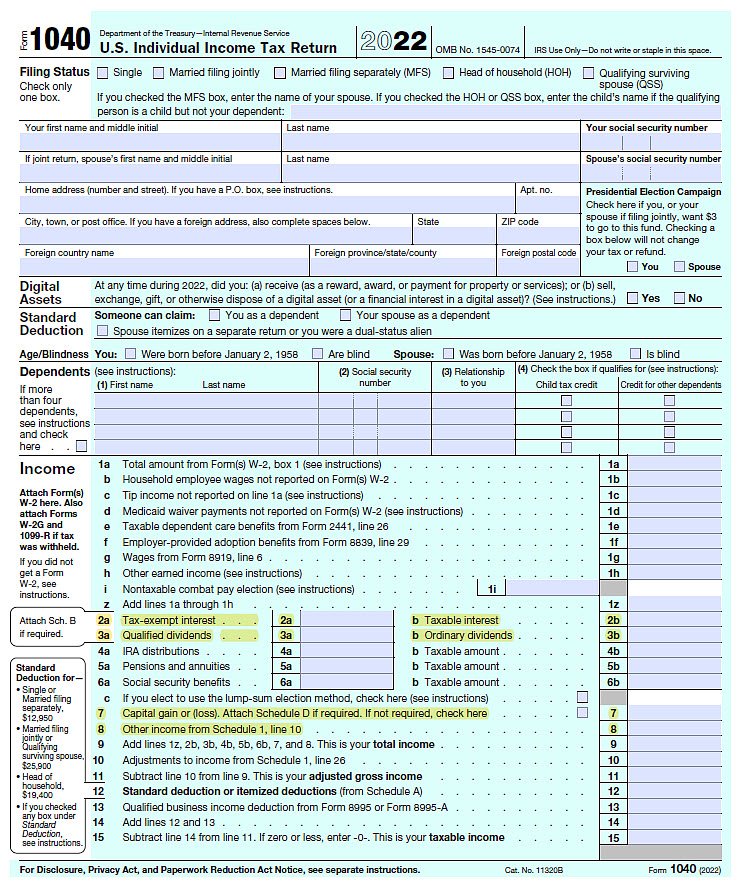

To minimize the amount of taxes you pay due to your investment activity it is first helpful to identify and understand the boxes on the 1040 that are related to your investments.

Line 2a – tax-exempt interest – tax-fee distributions from municipal bonds

Line 2b – taxable interest – interest you earn from banks

Line 3a – qualified dividends – dividends paid by US large companies

Line 3b – ordinary dividends – dividends paid by other companies including international and from taxable bonds

Line 7 – capital gains or (loss) – what you receive from selling a capital asset like a stock or real estate

Line 8 – other income – can be a lot of things but often operating gains/losses from limited partnerships

Tax efficient investing in large part means making sure that you are putting the right asset classes in the right accounts (IRA vs non-IRA) so you are taxed the least based on your tax rate. Examples of asset classes are large company stocks, small company stocks, US treasuries, commodities, etc. The trick is to #1 buy the right assets classes according to your risk level and diversify and #2 locate them in the right account.

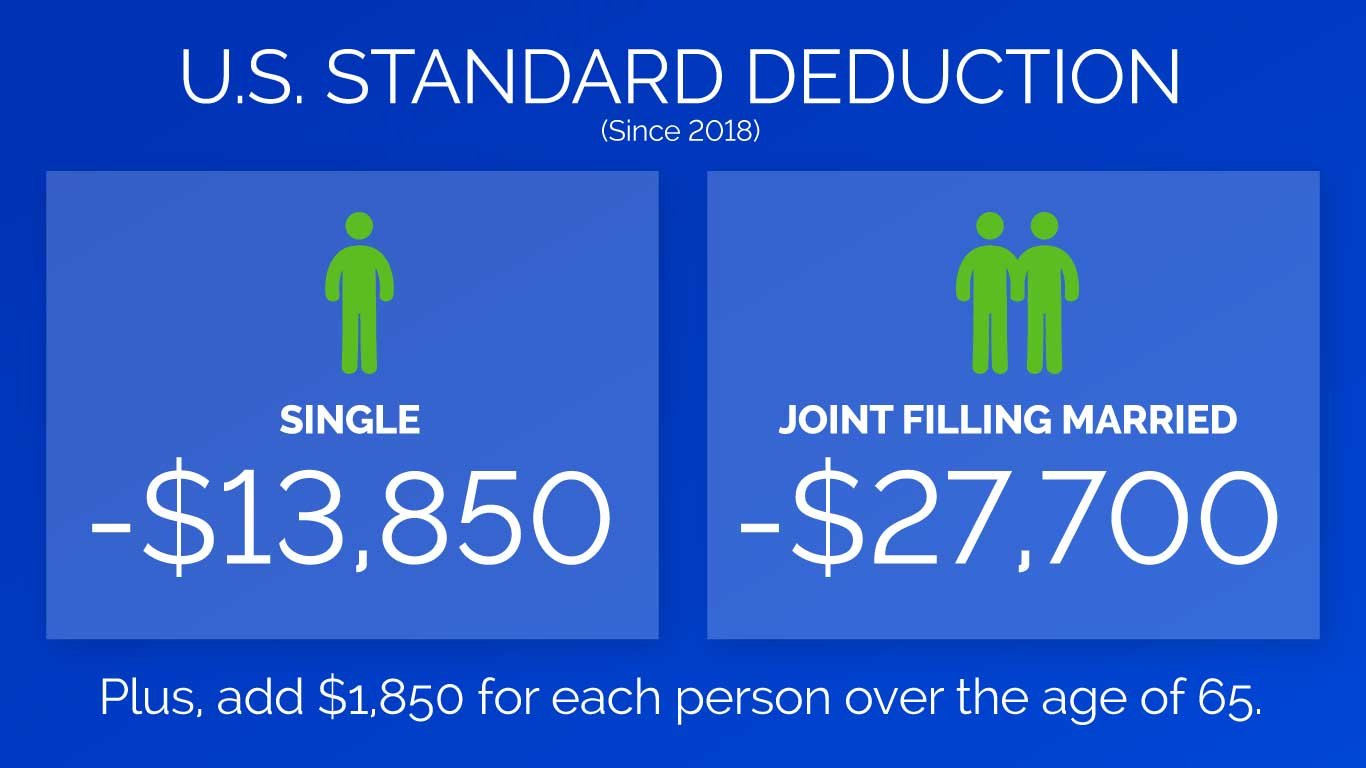

First, determine how you will file – single, married joint, head of household etc. Next determine if you are able to itemize your deductions or use the standard deduction. Now over 90% of US tax payers file using the standard deduction since it was raised back in 2018. For joint filing married the standard deduction is now $27,700 plus $1,850 for each person over the age of 65. It’s $13,850 if you are single. Next subtract the standard or itemized deductions from your income to determine what you approximate taxable income is and then subtract the corresponding tax rate. If you are 330K (joint) or 165K (single) you are getting into the upper tax brackets and the tax breaks for lower income folks begin to disappear.

For example, if you are and will continue to be under 81K (MFJ) and 41K (S) in taxable income, qualified dividends and long-term capital gains are TAX FREE! We have many clients who have a lot of money and are in these lower income brackets. So, don’t assume that people with more money are necessarily in higher tax brackets, especially if they have mostly non-retirement account assets. On the other hand, if they have mostly qualified retirement accounts, at age 73 they will be required to make minimum distributions which are treated as ordinary income and could push them into a higher tax bracket. Your tax situation could change dramatically at that point.

But, let’s say that someone is in and will remain in a lower bracket, it is best to put your US large company stocks in your retirement account and/or realize long-term capital gains up to the point where they start getting taxed (81K MFJ and 41K (S). If you are under 330K (MFJ) and 165K (S) then you will probably want to put your higher yielding securities such as bonds in your IRA so that they are not taxed at ordinary tax rates. And, you may want to opt for tax-free municipal bonds vs taxable bonds in your non-retirement account. But, if you are in lower brackets, those taxable bonds might be better than muni’s (net of tax) because they have a higher yield. So, you can see where every situation can be very different.

It’s important to evaluate your current tax bracket/rate to what it could/will be in the future so you are making good long-term decisions and you are not stuck with money in the wrong accounts and can’t unwind them without paying a lot of taxes. A good advisor can guide you through the process and should be able to provide you with tax estimates for a variety of scenarios. Good tax location management can save you thousands of dollars no matter if you are in a high or low tax bracket. In fact, it could be argued that folks in the lower brackets have more opportunities to save real tax dollars. Finally, one last thing to remember is that social security and the cost of Medicare supplements ratchet higher the more money you make, so it is important to look at the whole picture when you are creating your strategy.

Next up – Use a QCD vs making cash charitable donations